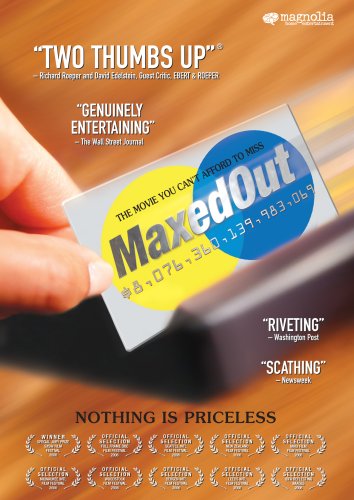

Whoa. Stop right there. Yes, YOU! You need to seriously consider watching this movie, a documentary called Maxed Out if you are not familiar with Dave Ramsey and his seven steps to getting out of debt.

The average family's credit card debt is over $9,000. Credit card debt alone. That is a scary thought.

A few years ago, when we bought our two-story, too-big house, we were doing just fine as both Stefan and I had great jobs that paid well. We decided to buy a house instead of "throwing money away on rent". We got some bad advice, and we took it. Wells Fargo was more than insistent that we could easily make our mortgage payments every month. Sign. Sealed. Delivered. We were theirs.

Fast forward one year and our property taxes go up, making our mortgage go up $80+/month and I was staying at home raising our little guy. Stefan changes his job (long story, he had to switch jobs because he thought he would loose it, and henceforth had to take a pay cut) and we get stacked up with our huge maternity/hospital bills. Plus our monthly credit card debt we got buying crap. I don't even know what kind of crap. Just crap we didn't need.

This is becoming the story of the average American. Debt and paying interest until they're dead or choose bankruptcy...and it is so sad.

We stuck it out, cut out everything for over a year that was a luxury, paid off Lu's bills, then wiped out 2 credit cards completely. Gone. Closed. And after this next one is gone (which by the look of it, will be soon as we triple our payments every month on it!), we will never have a credit card ever again. Why would you need one if you have an emergency savings and are only buying things you need with cash you have earned? You don't. What you need to do is watch this movie, get informed, and read up on Dave Ramsey. Get rid of your debt and get serious about it. It's hard, it stinks, and no, we were'nt able to go out to eat for over a year unless someone offered to take us, nor did we go to a movie, or buy any new clothes for over a year, or go to a movie! But we don't have the stress of it hanging over our heads anymore, and that sweet relief is so worth the peace of mind. I'd rather endure for a small amount of time than always being a slave to someone else who I owed.

Three things you should know:

- Your rent/mortgage price should never exceed more than 25% of your take home pay. It is very hard to do things like entertainment or save properly if it's more. Our mortgage at one point was 33%, and although it doesn't sound like much, it nearly sucked us dry living paycheck to paycheck.

- You do NOT have a constitutional right to privacy from anyone except the government. This means that any corporation or individual can buy your information (including your credit score and financial information) and it is completely legal!! Be aware of where your money is going!

- Credit card companies admit that the weakest link (i.e. the poorest person who is desperate to pay off medical bills, what-have-you, the person who is in the worst position to pay another bill) is the best customer because CCCompanies make their profit on them by interest and late-fees (if you pay the minimum payment on $1000, you will be paying it off for 30 years! That is A LOT of money in their pocket!)

I came to the conclusion that not only was I making an idol out of "stuff", I was loosing sleep over it...until we decided to stop living like the Jones'. It was killing us. We sold a bunch of stuff that we didn't need, and although it looked fancy, cool, trendy, whatever, we didn't care about it anymore. We wanted out of this slavery of debt. Now we have the mindset that excluding family, if our house was robbed, we wouldn't care-- it would be a hassle to clean up, but they can have whatever they want, because it's just stuff. Take it! I certainly don't need it, and I can live without it (and most likely have been without even realizing it).

Comments

I'm definitely adding this movie to my Blockbuster queue!

One other thing we have found: the more we are committed to faithful tithing, the more disposable income we seem to have every month. God works in mysterious ways! Actually, they're not so mysterious are they?